[Guest Writer Adam Bellingar is a lifelong Bellingham resident. He owns Traditional Karate of Bellingham where he teaches martial arts. You can usually spot him running around Lake Padden. ]

This analysis of housing in Bellingham is intended to be non-partisan and spur reasoned discourse. The data is largely from the Bellingham Planning and Development Department, Western Washington University, local data of student housing listings, and my own experiences with policy makers/planners/builders. In my opinion, the politicization of issues around housing has led to sub-optimal policies. This article will focus on housing affordability in Bellingham, why it has gotten worse over time, and some proposed changes to make it better.

Housing affordability involves two primary issues: The amount of housing construction, and the mix of housing types being built.

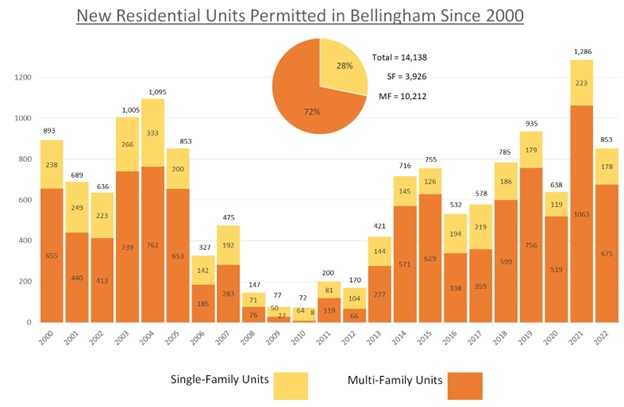

Bellingham has been chronically under-building housing units for decades. Whether multi-family or single-family, we have run a deficit of new construction housing units relative to population growth since the mid-2000s. The math is straightforward. Bellingham has grown an average of 1-2% per year for decades. Yet beginning in 2006, the number of new permits issued by the Planning Department dropped considerably for an eight-year period. While the number of permits rebounded in 2014, there still aren’t enough permits being issued to reverse the doldrum period of the financial crisis years.

Currently, Bellingham has 42,230 housing units for a population of 95,960, making the average occupancy rate 2.27 people per unit. Our current vacancy rate of 2% has held steady since 2015. A typical vacancy rate is 5-10%, which allows for modest rental rate growth and for renters to find housing that suits their needs. So how do we get to a 5% vacancy rate when just to keep up with our 2% population growth we need approximately 850 new housing units? To make a dent in that 2% vacancy rate, we need to at least double the housing construction rate for a number of years. Basically, we need 2,000 housing units permitted every year for 2-3 years to stop excessive rent increases and relieve the acute financial pressure we are all feeling.

So what are the main challenges to getting 2,000 housing units per year?

When I talk to builders about the process of obtaining a building permit in Bellingham, they tell me the process often takes more than a year. For larger projects, it can take considerably longer when factoring land use changes and infrastructure. While public notice requirements may factor in, many of the complaints are about the lack of customer service from the Planning Department and the siloed nature of permit approvals. This uncertainty around the process is a significant headwind for builders trying to choose where to build houses or multi family projects. There have been very few spec home builders operating in Bellingham. Why build here when you could build in the county or other cities that have a more favorable regime? This is clearly a management issue by the mayor’s office. The Planning Department needs much higher capacity for permit issuance. Both the current administration and past mayors have ignored this issue for too long. The target should be 90-days from application to approval decision.

Turning to the mix of housing constructed, the push for increased density appears to have backfired when it comes to affordability. Objectively, higher density is associated with higher pricing when it comes to housing (cities are more expensive than rural areas). The push to higher density is a function of the state’s Growth Management Act. However, our communities get to decide how to apply it. Density and affordability are two separate concepts, but are treated as if they are solving the same problems. Higher density is a solution for environmental and space limitations. Affordability is a function of supply and demand (as discussed above) - but also housing type. Home-ownership in Bellingham has become heavily tilted toward investors who are incentivized to maximize profits, and these owners don’t typically live in the multi family projects they build.

Since the 1990s, Bellingham’s ratio of renters to owners has consistently skewed toward renters. While you can build a multi family project and address an immediate housing need by adding more supply, over the long run, there is an actual negative effect on affordability. How so? Let’s compare the effects of inflation on a renter versus an owner/occupant. A renter with a for-profit landlord obtains a lease at a market rate at the time of occupancy. The renter usually has an annual renewal of the lease resulting in an annual price increase that may or may not match their income increases. The investor/landlord gains the benefit of inflation while the renter pays higher and higher rates every year. A homeowner, on the other hand, purchases a house at the then-market-rate and usually obtains a 30-year fixed-rate mortgage which essentially fixes the cost of their housing until they sell. The homeowner benefits from any inflation in housing costs as the value of the home goes up while the loan payments stay the same and the balance goes down, in the same way that a real estate investor does. Over time, this is a significant compounding of inflation that burdens renters and is a boon to owners, even at modest rates. Rental units almost always become unaffordable over time because income prospects diminish and flatten as a person reaches old age. There are many local instances of elderly renters in subsidized housing who still can’t keep pace with even modest rent increases. Inflation protection is what they need most - not subsidies.

Bellingham’s Planning Department has both operationally failed to plan for growth (a permitting process issue) and consistently shortchanged home ownership (a policy issue). Bellingham has been building multi family units at a nearly 3-to-1 ratio to single family homes. Renters who want to get off the rental inflation treadmill don’t have a chance because there are no homes to buy. The beneficial increases in the cost of housing consistently go to a smaller and smaller pool of homeowners and investors. Folks who would be eligible for home ownership in a more balanced housing market crowd out lower income renters because the supply of homes for sale is so low.

Two unique historical features have had a significant impact on Bellingham housing and affordability.

The first was rental registration and inspection requirements which were enacted in 2015. This had the effect of pushing most rental units into the hands of a small number of property management companies. Landlords who predominately use property management companies create what economists call “asymmetric information.” This asymmetry allows property managers access to data on hundreds if not thousands of rental properties that they manage, while renters have a limited window into the housing market. Mom-and-pop landlords turn to property managers because it removes the regulatory burden, including having to understand real estate law. It also allows them to raise rents from a distance, without having to look a tenant in the eye. In effect, rental property in Bellingham has become an oligopoly where a small number of providers have a high level of pricing power over most of the rental market.

Rental registration also led to the sale of many low income rental units to more profit minded landlords. Many of the rental homes that provided affordable housing were in poor physical condition. Faced with the large capital outlay that was required to meet the new rental registration and inspection criteria, many landlords elected to sell rather than spend the money to improve their properties. They ended up selling to new owners with money to invest in the properties. The new owners needed much higher rents to make the higher debt payments and investment returns of the now more costly property. The rental registration made these units safer, but it also took away most of the affordable housing provided by private landlords.

It is evident from the second chart, above, that rental registration had a dramatic effect on vacancy both locally and in Western Washington in general, as both Bellingham and Seattle enacted registration policies within 90 days of each other in 2015. While rental registrations have set minimum standards for safety and living conditions, there is clearly a detrimental impact on availability and affordability of housing.

The second unique feature in the Bellingham housing market is the large impact of Western Washington University (WWU). After peaking at over 16,000 enrolled students in 2019, the fall enrollment for 2022 was below 15,000. Bellingham’s population is highly impacted by the seasonal influx of students. From a housing standpoint, this influx is inefficient due to the roughly nine month school year housing needs relative to the rest of the city’s population that has a much steadier need for housing.

The campus itself has capacity for 4,145 students in 16 residence halls - meaning that approximately 10 -11,000 students live off-campus. One effect of having so much rental demand driven by WWU (10% of our population) is that their leases start and end according to WWU’s calendar. This mad rush at the same time every year adds to the inefficiency of our housing market.

Let’s compare housing costs for on-campus versus off-campus. On-campus, students commit to residency for a nine month academic year and receive meal plans with their housing. While there are different housing/meal plan options, they average less than $2,000 per month for meals and housing, with an implied housing-only cost (2/3rds) of approximately $1,200-1,300 per month (inclusive of utilities) for a single room occupant (standard plan). Off-campus, students usually sign a 12 month lease. A standard single room rental with utilities is approximately $875 per month (adjusted to a nine month equivalent rate would be $1,167 per month). Off-campus housing often requires the co-signature of a parent due to income, credit, and rental history that students typically lack. The lack of on-campus housing works strongly in WWU’s favor and drives thousands into the Bellingham rental market.

Beyond the Growth Management Act, there are two significant state laws that factor into Bellingham’s housing issues and affordability.

Washington state has a Multi Family Tax Exemption (MFTE) in an effort to promote housing density. The program allows real estate tax exemptions for periods of years in return for construction of new multi family housing with five or more units. Local municipalities have some discretion as to how to implement this. Bellingham and Seattle both have MFTE programs. Bellingham initiated a MFTE program in 1999 in response to downtown blight following the construction of Bellis Fair Mall in 1989. Bellingham’s housing MFTE is structured for two programs. One is an eight year tax exemption for construction of at least four additional housing units on a property (minimum five housing units total). Bellingham’s second program requires at least 20% of the units be affordable in exchange for a 12 year tax exemption. It is noteworthy that as of my interaction earlier this year with the planning department, no one has used the 12 year program, perhaps because of a significantly higher burden of reporting and qualifications for the 12 year exemption. Seattle requires a low income component for all their MFTE programs as well as ongoing monitoring of compliance and periodic renewals of the overall program.

Since the issue of affordability has become considerably more pronounced in Bellingham, it seems odd that the MFTE program hasn’t been rethought or revamped since no one is using the 12 year affordable housing program. The benefits of the eight year MFTE is being heavily utilized by landlords who are charging market rates and increasing rents on an annual basis. From a density standpoint, there is probably some advantage to the market rate program… but is that what we want, considering that the cost advantages (tax breaks) are going exclusively to profit driven landlords?

The final state policy in play in Bellingham is the legal liability incurred by developers of condo projects. Condos are an obvious solution to both density and affordability as they allow for unit ownership in multi family housing. But post financial crisis, the state enacted liability laws on condo associations that put significant financial risk on developers, causing insurers to drastically increase the cost of liability insurance coverages for developers. As a result, condo construction has all but ceased in Washington and Bellingham. While the law helps prevent homeowners from being taken advantage of by builders, the result has been a near complete collapse of new condo construction. There are other density solutions, like townhomes, that offer ownership in tighter configurations than a single family home, but they are significantly less dense than a tower condo project.

Considering the above, and because these problems aren’t unique to Bellingham, the following policy and administration changes could be applied to many municipalities. When it comes to enacting solutions, density and safety are primary goals. But we cannot rely on the state to enact fixes. If we figure out solutions to this problem others will follow our lead.

1 - The mayor of Bellingham should take a long hard look at processes and staffing levels in the Planning Department. The use of third party contractors should be considered to work through backlogs. The focus should be on prioritizing owner occupied properties over rentals at a two-to-one preference. If multiple departments need to approve a permit, the burden should be on the Planning Department to facilitate the approvals in a timely manner. Decisions should not be subject to a planner changing their mind after an approval has been issued. Appeals should be less of a hassle for builders and neighbors - with quicker turnaround.

2 - The Planning Department should target a minimum of 2,000 housing units approved per year until stabilized vacancy rates are achieved. Permit and impact fees should be reduced or even eliminated if we aren’t hitting these targets.

3 - Rental registration should be simplified for non-professional real estate investors. Assistance programs designed to help landlords meet compliance are too complex and almost never utilized. We will likely not be able to get back the mom-and-pop landlords that provided a substantial portion of affordable housing, but we shouldn’t further push small-scale landlords into the hands of property management companies or the sale of their properties. Safety concerns should focus on actual safety issues encountered in the enforcement of registration and inspections.

4 - WWU should construct capacity for an additional 4,000 students on campus. This target should be possible with 1,000 housing units or less. Density should be utilized where it makes the most sense and communal living works extremely well for young adults. Further development of campus should not be permitted until WWU stops externalizing the cost of it’s growth on the rest of Bellingham.

5 - The MFTE program should be changed significantly. The market rate MFTE should be either eliminated or shortened from eight years to no more than two years. The affordable housing MFTE should have the threshold of required affordable housing increased to 50%. The tax exemption period of the affordable housing MFTE should be shortened to eight years, since that is what the market seems to support.

6 - Require all new construction multi family projects be structured as condominiums. The properties won’t be required to be sold as condos and can be leased as a conventional rental. When and if the condo liability laws are changed at the state level, landlords would easily be able sell those housing units to individual owners.

7 - Non-profit or government agencies should be allowed to set up a program to purchase existing multifamily properties and convert them to condominiums or co-ops. The structures should be inspected and repaired where necessary, reserves built up for association needs, and then the units should be offered for sale to existing tenants first. Vacant units could be sold to any eligible buyer. The agency could offer non-profit versions of “rent to own” that help equalize wealth and income disparities in the community. Proceeds would be recycled back to purchase other multifamily properties. This has the advantage of taking the condo liability issue away from builders and the process is scalable—unlike current low income housing non-profits focusing on new construction. This won’t create new housing, but it will create affordable, owner-occupied housing in the long run—specifically housing that is protected from inflation.

While these proposals won’t solve the issues of economic malaise or high interest rates - over time they could go a long way to rebalancing the housing market in Bellingham.

Comments by Readers

Maggie Carrigan

Oct 15, 2023Perhaps we could take a look at some information regarding just how many Canadians come down here and buy property. They have homes to live in and summer homes. Most likely they are buying property to rent and lease to our folks in Bellingham as well as to their friends in Canada.

On January 1, 2023, Canada passed a law banning non-Canadians, or foreign corporations from buying property in Canada by any means. I’m sure we are a good investment for them. Any new housing should have to be owner-occupied by a US citizen. I’m not anti-Canadian. My grandmother was born there and I have lots of family up there, but they should stay there in their own homes.

Liz Marshall

Oct 15, 2023Impressive contribution, Mr. Bellingar!

Michael E. Smith, FAIA

Oct 15, 2023I agree the Planning Dept is a problem, it takes far too long for even the simplest of permits. The department is understaffed, and there is a severe shortage of qualified applicants. Outside plan review works for building codes, because they are standardized, but zoning codes are unique to every jurisdiction. I would like to hear from the Planning Department how they could envision outside plan review working wirh respect to zoning codes. I remember touring the Vancouver BC downtown library shortly after it was completed. The leader of the tour was the project architect. Somebody asked “how long did it take to get permits?” The answer was one day, because outside plan review was used.

The other problem is available land - there is very little available, especially large tracts, resulting in outrageous prices. When I first moved here in 1976, the city population was under 50,000. Less than 50 years later it is nearly 100,000. That means in another 50 years it will be 200,000, and in 100 years 400,000. Consider this: 100 years ago there were single family homes in downtown Seattle. The Planning Department only looks forward 20 years at a time, because that is what the State requires. But we need to be looking 100 years ahead - where are all these people going to live? How are we going to maintain the quality of life that we currently enjoy? We need visionaries in the City.

Carol Follett

Oct 15, 2023College students come and go. They represent a transient group, a community within our community that we value, but that should be primarily cared for by Western Washington University.

I am concerned about the needs of those who live here now. Where is the discussion about low wages, unemployment and underemployment? You speak of “affordable housing,” but for those earning poverty wages, in deep poverty, or needing financial support, nothing decent will be “affordable.”

If adults and families are moving into Bellingham, what is bringing them here? What is their income? What are their needs? The GMA does not inform us about how to provide for new community members in need.

Additionally, as a 35 year resident of Bellingham, when I drive past the monstrous new apartments built here, I am ever grateful for the somewhat protected wetlands and the small (how small they will look soon) greenways. The apartments are as lovely as looking at bird cages. Mean and ugly housing, without vision or care for the humans that will live there is just serving greed and using the GMA and environmental protection as a smoke screen.

Children and others need and deserve to live in and with greenery, not to have to leave home to enjoy it. And we do not deserve to look at prison style housing when we go about in our community.

This is not a discussion about building for students, the unhoused, or the poorly housed. This is a discussion about making it easier to build profitable housing, profitable for developers and real-estate corporations.

If we care, we need to know for whom we are building and be ready to employ able adults with living wages (not irregular, low paid service jobs), and provide the amenities that make a community healthy, safe, and happy. To issue permits for the sake of quotas will ensure we, and those who come after us, have an unpleasant place in which to live.

Ali Taysi

Oct 16, 2023This is a well written and thoughtful article detailing some of the underlying causes of our affordability crisis. I think many of Mr. Bellingar’s recommendations are well made, in particular those related to permit review timeframes, housing supply goals, and condominiums. As a community we have made a clear and concious decision in our Comprehensive Plan to focus on infill and to limit expansion of our corporate limits (growing up and in, not out). This limits the supply of land for ownership models of housing and focuses the development community on larger scale MF buildings. If the insurance and liability issues that create barriers to condominium development were eliminated this would surely encourage developers to consider for sale condominiums as an alternative to for rent apartments. I do disagree with the recommendation regarding the MFTE. This has been a successful subsidy program and in my professional experience utilizing the program many times, the use of the 8 year MFTE for market rate projects has made many of them viable. I would discourage elimination of what is the most successful subsidy the City has implemented to encourage infill development (albeit for rent MF development). The State also offers a 20 year MFTE. I would instead encourage the City to maintain the 8 year MFTE for market rate projects, but change the 12 year MFTE for affordable projects to be a 20 year MFTE, and keep it at 10% or 20% of units. I have done the math on many projects; the reason no one has used the 12 year MFTE is because the tax breaks do not equate to the reduced revenue over a 12 year term. In other words, it doesn’t pencil. If that subsidy was shifted to a 20 year term, then the math looks a lot better, and for profit developers might be encouraged to utilize it and incorporate a % of affordable units into their projects. Reducing it to 2 years for market rate projects, or 8 years for affordable projects, or requiring 50% of the units be affordable, just makes the math even worse, and the end result will be that no one uses either program.