Marijuana Policy Update - 2016 Election Edition

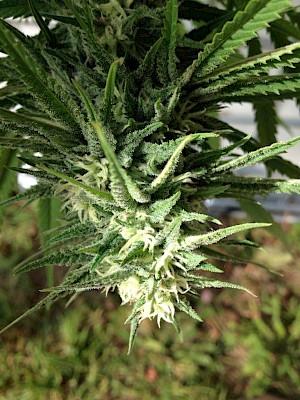

Indian Hemp Flower, female, unfertilized, Oct 2015 .

Marijuana Policy Update - 2016 Election Edition

Marijuana Policy Update - 2016 Election Edition

It bears repeating - the Great State of Washington, whose citizens are blessed with an abundance of good sense and a robust public initiative process, have in the face of a brutal and prolonged prohibition of almost seventy years, re-legalized all varieties of hemp, including indian hemp. And, in a State also blessed with no income tax, are faced with a perennial revenue requirement to be met with sales and excise taxes.

So what has this re-legalization accomplished in this regard? Consider this data from the State I502 Data website:

Total Legal Retail Marijuana Sales to Sept 30, 2016: $ 1,145,640,312

(Yes that is over one Billion!)

Total Sales and Excise Taxes Paid on Marijuana: $ 427,736,638

(Yup - over $400 million!)

All this economic activity and huge addition of funds to the State’s coffers is testament to the hard work of all involved in this now legal and regulated industry, including growers, processors, retailers, WSDA and WSLCB. And all in the face of continuing obdurate and unjust hostility from the federal apparatus, which uses the prohibition of cannabis for various employment purposes. Veterans risk losing their VA benefits if they use this safe, non-toxic medicine. Students with a minor misdemeanor marijuana offense are ineligible for federal student loans (unlike, for example, murderers or thieves, who are eligible!).

Legal cannabis businesses cannot open a bank account – federal law forbids banks from dealing with them. They also have a serious problem with the IRS – which considers that as illegal businesses, they cannot deduct their normal and customary business expenses but must pay tax on their gross income, including excise taxes! And, due to a regulation that governs tax preparers, Circular 230, their CPA or other tax advisor is required a) to inform their client that their business is illegal, and b) to resign and no longer serve their client, since under Circular 230, a tax preparer cannot associate herself with a client involved in an illegal business.

SO the federal government stands in restraint of trade legal in Washington State - what an insult to any definition of freedom - should we not expect our Representatives which we send to Washington DC to correct this matter? Propose to remove these terrible unjust laws of prohibition cooked up in some dirty corrupt deal during the FDR administration and continued against political enemies ever since by Nixon, Reagan, and Clinton the first?

Not, apparently, if you live in WA 2nd District and are represented by Rick Larsen. Mr. Larsen is a six-term incumbent and did not get that way by taking any risks. Did he sign on as co-sponsor to the timid H.R.1940 -Respect State Marijuana Laws Act of 2015? Or H.R. 1538 Compassionate Access,

Research Expansion, and Respect States Act of 2015 ? Or H.R. 667 Veterans Equal Access Act , which allows veterans to access State-legal medicinal marijuana and not lose VA benefits? Nope to all.

Here we can see a concrete example of a sclerotic, gerrymandered system, where incumbents don’t really have to do anything but show up and vote the way they’re told and press the flesh locally from time to time. Not exactly an environment that encourages leadership. SO we get office holders, middle managers, salute the flaggers. It’s great that we can actually change things as citizens in Washington State. Too bad we can’t seem to do so at the federal level, where only money talks, apparently. Maybe the numbers at the top of the page might catch their attention.

Prepared as a Public Service by David M. Camp, cpa WA License # 30879

This article is copyright by the author under Creative Commons License CC BY 3.0 – Share with

attribution.